Some Known Details About Understanding Insurance The Basics

When we hear the term "insurance policies," what comes to brain? For many, it’s a posh earth stuffed with bewildering phrases, fine print, and seemingly endless options. But at its core, being familiar with insurance plan the basics is just about safeguarding what issues most to you: your health, your property, your income, and your life. No matter whether you’re a youthful Grownup just starting out or a person looking to evaluation your coverage, understanding the basics of coverage is crucial.

Think of insurance policy as a security Internet, a method to safeguard you in opposition to surprising fiscal burdens. Lifetime features a technique for throwing curveballs, and when catastrophe strikes, insurance coverage can help soften the blow. But how precisely will it perform? To start with, coverage is usually a contract in between you and an organization. You fork out them a regular sum, often called a top quality, and in return, they promise to go over specified expenditures if anything goes wrong.

At its most basic, the target of insurance coverage should be to share the danger. Allow’s say you enter into a car or truck accident. Instead of paying for all the damages from pocket, your vehicle insurance company ways in to protect most or most of the expenditures. In essence, insurance policies swimming pools assets from a lot of individuals, helping Everybody shoulder the financial load in situations of need to have. This idea of shared threat is the foundation of just about all coverage policies.

You will find a variety of types of coverage, each meant to guard different facets of your daily life. Wellness insurance plan, for instance, will help cover health care prices, while homeowners insurance policies protects your house from damages like fires, floods, or theft. Life coverage presents money stability for your family from the event within your passing. Automobile insurance plan, given that the title suggests, covers The prices associated with auto incidents or damages for your car or truck.

What Does Understanding Insurance The Basics Do?

One of the to start with things to be familiar with is how coverage rates are calculated. Insurers choose quite a few aspects under consideration when determining just how much you’ll pay out each and every month. For wellbeing insurance plan, they may examine your age, overall health heritage, and Life style possibilities. For automobile insurance plan, the make and product of your automobile, your driving background, as well as your place all arrive into Enjoy. Premiums are in essence the cost of transferring hazard from you on the insurance company, and the more danger you existing, the higher your top quality might be.

One of the to start with things to be familiar with is how coverage rates are calculated. Insurers choose quite a few aspects under consideration when determining just how much you’ll pay out each and every month. For wellbeing insurance plan, they may examine your age, overall health heritage, and Life style possibilities. For automobile insurance plan, the make and product of your automobile, your driving background, as well as your place all arrive into Enjoy. Premiums are in essence the cost of transferring hazard from you on the insurance company, and the more danger you existing, the higher your top quality might be.It’s also vital to grasp deductibles. A deductible is the amount you have to pay back from pocket before your coverage coverage kicks in. One example is, Should you have a wellness insurance plan program that has a $1,000 deductible, you’ll have to fork out the 1st $one,000 of health care costs you. After that, your insurance coverage may help deal with more expenses. Deductibles could vary according to the style of insurance plan and the precise coverage you select. A number of people select higher deductibles in exchange for reduced rates, while some desire decreased deductibles for more instant coverage.

When thinking about coverage, it’s vital to know the distinction between what’s covered and what’s not. Not all predicaments are lined by each and every policy. As an example, homeowners insurance policy commonly covers damages from fireplace or vandalism, but it really won't cover damages from the flood or an earthquake. If you reside in a place susceptible to flooding, you might want to invest in supplemental flood insurance plan. This idea of exclusions—what isn’t lined by a coverage—has become the trickiest aspects of coverage.

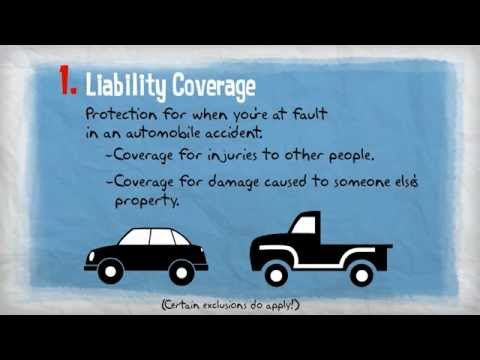

For people of us who rely on our autos to receive from level A to stage B, knowledge auto insurance plan the basics is significant. Auto insurance coverage is necessary by legislation for most states, although the coverage it provides could vary widely. Liability coverage, one example is, handles damages to Other individuals or house should you’re at fault in a mishap. Collision insurance policy aids maintenance or swap your vehicle if It is weakened in a very crash, whilst extensive insurance coverage covers non-collision functions like theft, vandalism, or normal disasters.

But don’t be fooled into believing that all insurance policy companies are the exact same. Although they might give very similar insurance policies, different suppliers could possibly have different guidelines, pricing structures, and customer care reputations. It’s crucial that you store all-around and Evaluate policies prior to committing. A couple of minutes of investigation could preserve you a substantial sum of money in rates or make it easier to uncover far more comprehensive coverage for your preferences.

Let’s shift gears and discuss lifetime coverage. Everyday living insurance coverage isn’t only for more mature men and women or Those people with dependents—it’s a important Instrument for anybody hunting to shield their family and friends financially. If a little something ended up to occur for you, lifestyle insurance policy provides a lump-sum payment to the beneficiaries. This could certainly assistance go over funeral charges, debts, and everyday dwelling charges. There are 2 main types of daily life insurance plan: phrase and long lasting. Phrase lifestyle coverage handles you for a selected interval, while lasting lifetime insurance policy provides lifelong protection and can even accumulate cash worth over time.

When pondering everyday living coverage, look at what would materialize in the event you were now not all around. Would your family be able to spend the home finance loan or manage to send the youngsters to college? Would they wrestle with working day-to-working day dwelling costs? By owning everyday living insurance plan, you’re guaranteeing that Your loved ones gained’t be left with money hardship in the facial area of the now psychological and difficult predicament.

The most frequently ignored kinds of insurance policies is disability insurance policy. Should you become unable to perform because of health issues or injury, incapacity insurance policies provides a portion of your income to assist hold you afloat. It’s easy to presume that it gained’t come about to us, but the truth is mishaps and diseases can strike anybody Anytime. Possessing disability insurance plan makes sure that you gained’t be monetarily devastated If you're not able to work for an extended time period.

Comprehending the basic principles of insurance can seem too much to handle to start with, but when you break it down, it’s much easier to see the bigger picture. The leading intention of insurance policies is to provide you with comfort. By realizing you have coverage set up, you can Reside your lifetime with fewer panic of your unfamiliar. It’s about being well prepared to the unexpected and recognizing that there’s a security Web to catch you if you drop.